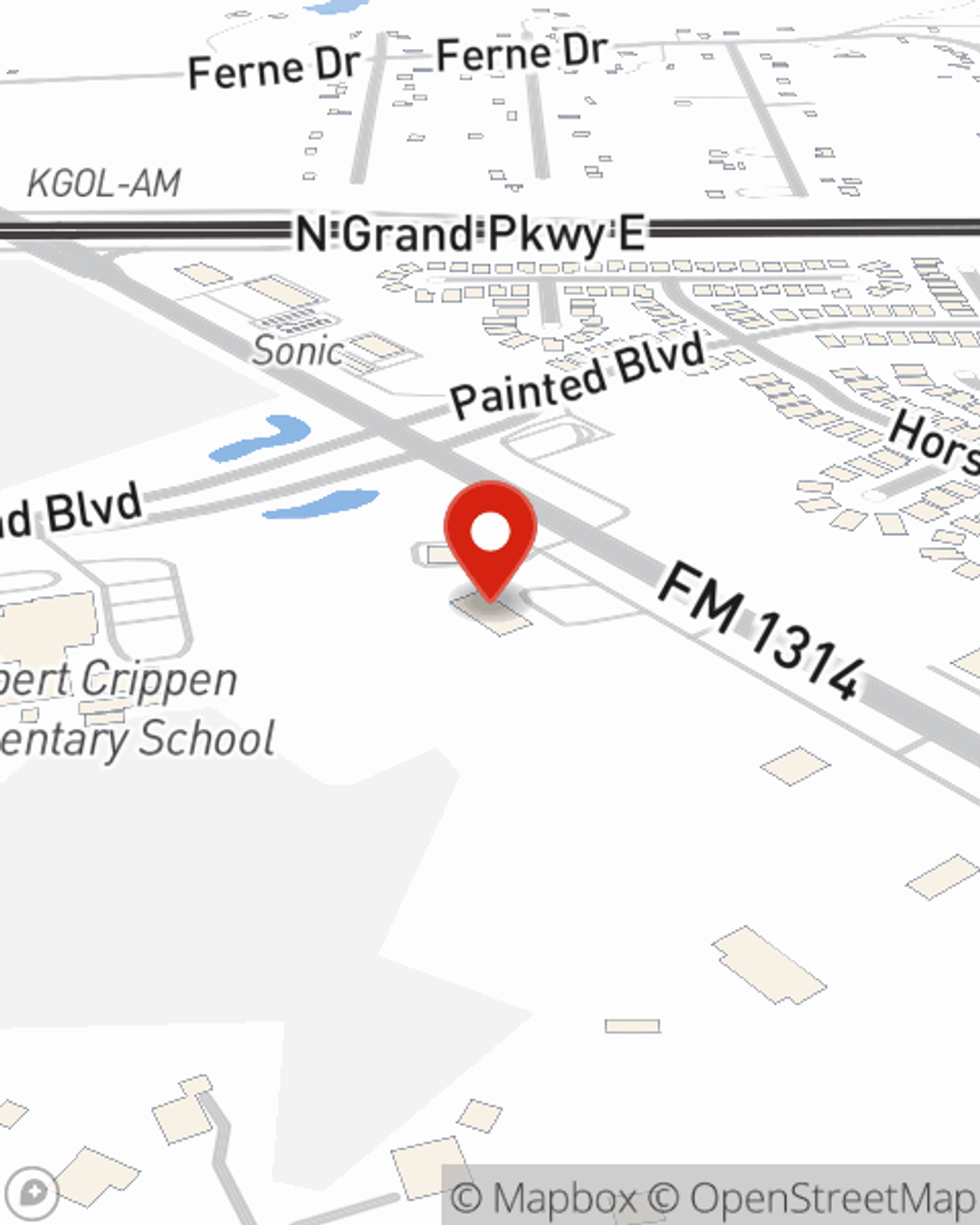

Business Insurance in and around Porter

Get your Porter business covered, right here!

Insure your business, intentionally

- Porter, TX

- Humble, TX

- Cleveland, TX

- Splendora, TX

- Spring, TX

- Kingwood, TX

- Houston, TX

- New Caney, TX

- The Woodlands, TX

- Huffman, TX

- Conroe, TX

- Montgomery County TX

- Texas, USA

- Harris County, TX

Your Search For Fantastic Small Business Insurance Ends Now.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Mishaps happen, like an employee gets injured on your property.

Get your Porter business covered, right here!

Insure your business, intentionally

Protect Your Business With State Farm

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like a surety or fidelity bond and worker's compensation for your employees. Terrific coverage like this is why Porter business owners choose State Farm insurance. State Farm agent Earl Chamberlain can help design a policy for the level of coverage you have in mind. If troubles find you, Earl Chamberlain can be there to help you file your claim and help your business life go right again.

Don’t let worries about your business keep you up at night! Get in touch with State Farm agent Earl Chamberlain today, and discover how you can save with State Farm small business insurance.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Earl Chamberlain

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.